31+ ideal mortgage to income ratio

Ad See what your estimated monthly payment would be with the VA Loan. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Ex 99 1

Ad Are you eligible for low down payment.

. Web A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a mortgage. Web Adding up with the ideal income ratio. How much home refinance of monthly gross monthly payments in hand with the size is often allow a monthly mortgage.

Web Lenders have different definitions of the ideal debt-to-income ratio DTIthe portion of your gross monthly income used to pay debtsbut all agree that a lower DTI is better. Get Instantly Matched With Your Ideal Mortgage Lender. Comparisons Trusted by 55000000.

Well help you every step of the way via our new online application. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall.

Ad 10 Best House Loan Lenders Compared Reviewed. Web Total monthly debt repayment 3485. Web Ideally lenders prefer a debt-to-income ratio lower than 36 with no more than 28 of that debt going towards servicing a mortgage or rent payment.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web A high mortgage to income ratio means that the person can easily pay off their mortgage while a low mortgage to income ratio means that the person may have. Total monthly household income before tax 10000.

Web Ideally lenders prefer a debt-to-income ratio lower than 36 with no more than 28 of that debt going towards servicing a mortgage or rent payment. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Get Your Home Loan Quote With Americas 1 Online Lender.

Web The Ideal Ratio The ideal debt-to-income ratio is 36 or lower. Well help you every step of the way via our new online application. These expenses include your principal and interest payment.

Apply See If Youre Eligible for a Home Loan Backed by the US. Find all FHA loan requirements here. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Ad We Provide Mortgage Resources to explore your loan options gain acccess to expert help. You earn 6300 a month working full-time. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web Debt-To-Income Ratio - DTI. Debt to income ratio 3485 divided by 10000 03485 3485 or 35. Save Real Money Today.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Multiply your total monthly gross income by 31 percent to determine your maximum monthly housing expenses. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Web Lenders typically say the ideal front-end ratio should be no more than 28 and the back-end ratio including all expenses should be 36 or lower. Ad Compare Home Financing Options Online Get Quotes. Web To calculate your front-end ratio add up your monthly housing expenses only divide that by your gross monthly income then multiply the result by 100.

Lock Your Rate Today. Banks want to lend to homebuyers with lower ratios in general as those with higher ratios are. 1 2 For example assume.

Ad We Provide Mortgage Resources to explore your loan options gain acccess to expert help. Your total debt monthly obligations amount to 2500 and are. Web Lets assume your current debt-to-income ratio is around 39.

Indispensable Real Estate Buyers Agent Checklist For Homebuyers True Buyer Agents Dc Md Va Naeba Members Buyer S Edge Buyersagent Com

Sec Filing Investor Relations Luther Burbank Corporation

31 Ways To Save For Halloween Sofi

How Much Of My Income Should Go Towards A Mortgage Payment

Low Income Student Loans Financial Aid Options Sofi

2022 23 Huntsville Isd Benefit Guide By Fbs Issuu

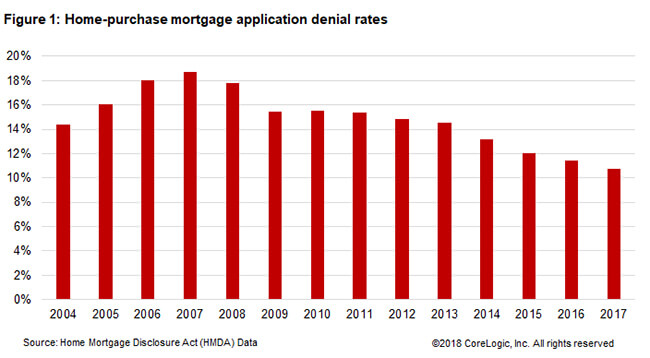

Debt To Income Is The Number One Reason For Denied Mortgage Applications Corelogic

A Picture More Misleading Than A Thousand Words John Burns Real Estate Consulting

What Percentage Of Income Should Go To A Mortgage Bankrate

Do Loan To Value And Debt To Income Limits Work Evidence From Korea In Imf Working Papers Volume 2011 Issue 297 2011

How Much Does It Cost To Sell A House In London Sell With Richard

Why Is It Good To Invest In Real Estate Mortgage Magic That S Why

The Top Startups Of 2022 Wellfound Formerly Angellist Talent

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Mortgage Brokers South Sydney Located In Rockdale Mortgage Choice

Mortgage Income Calculator Nerdwallet

The Percentage Of Income Rule For Mortgages Rocket Money